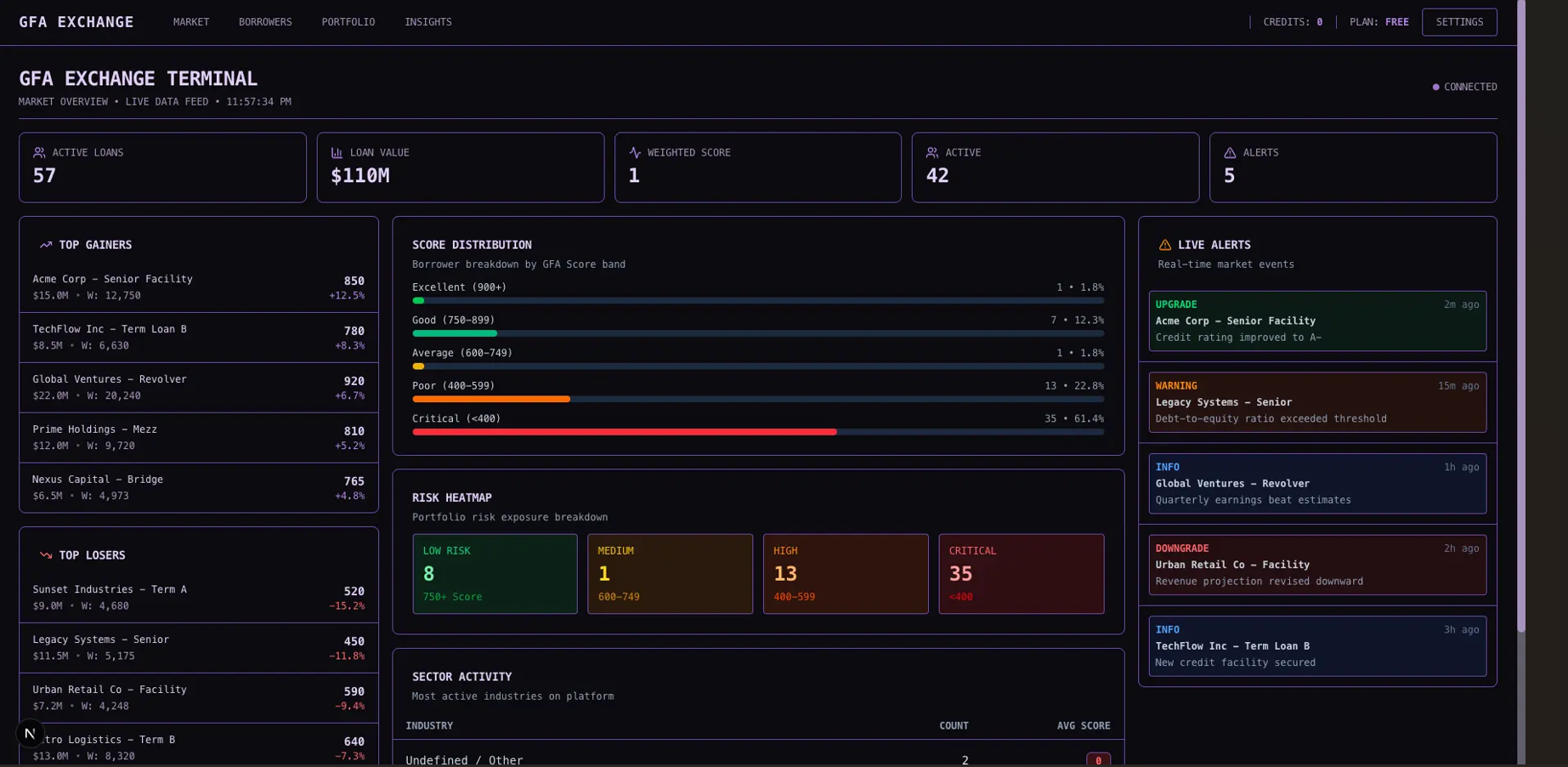

Market Infrastructure For Private Credit Risk

The neutral terminal where lenders benchmark borrower financial performance against the market to spot issues early & price risk better.

Trusted by leading credit investor, technology and industry organisations

.svg)

.svg)

.webp)