Private credit has outgrown legacy market risk systems

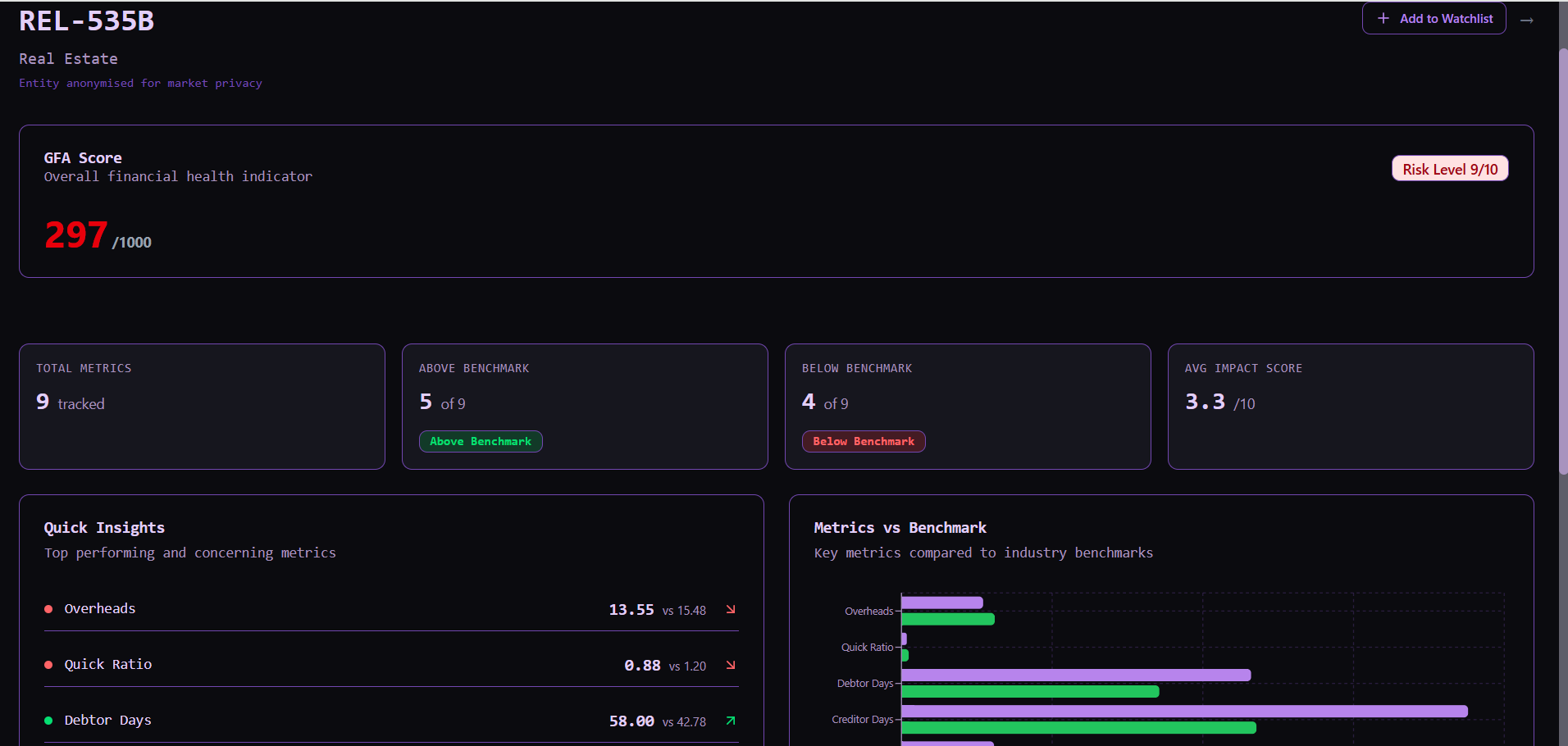

Traditional reporting methods, static credit scores, and opaque data

leave blind spots across your portfolio, potentially worth millions.

By the time risk or opportunity is visible, it’s often already priced in, leaving capital misallocated and concentration risks unmanaged.

Proudly supported by leading institutions...

.svg)